What information is important when preparing your Tax Return

The key areas that the Australian Taxation Office (ATO) will be focusing on when you complete your 2021-2022 Tax Return are: Recordkeeping Work-related expenses Rental property income and deductions; and Capital gains from crypto-assets, property, and shares When determining what…

End of financial year for Small Businesses

The end of the financial year for a small business is an important time. There are many things to complete such as bookkeeping, tax returns and planning for the new financial year. Learn how to prepare for the EOFY to…

How will the changes to Superannuation Guarantee (SG) affect you

From 1st July 2022, two important Super Guarantee (SG) changes will apply: the rate of SG is increasing from 10% to 10.5% the $450 per month eligibility threshold for when SG is paid will be removed. What does this means…

Rental property repairs, maintenance, and capital expenditure

Repairs and Maintenance The cost of repairs and maintenance may be included in full in your tax return in the year you incur them if both: the expense directly relates to wear and tear or other damage that has occurred…

Tax Return Lodgment reminder for Child Care Subsidy and Family Tax Benefit

If you have not lodged your 2021 Individual Tax Return by 30 June 2022, Services Australia may stop your access to your allocated Child Care Subsidy (CCS). This will mean that you will have to pay the full cost of…

Fiducian Economic April 2022 Commentary

The global economy has slowed in recent weeks. The International Monetary Fund (IMF) in its latest report (April), explained that ‘global economic prospects have worsened significantly’, noting that ‘the outlook has deteriorated largely because of Russia’s invasion of Ukraine’. This…

Transition to Retirement

Have you been thinking about retiring or reducing your hours worked that you are currently working. Starting your journey to financial freedom for retirement is never easy but you’re not alone. Fiduciian Financial Services are always here to help guide…

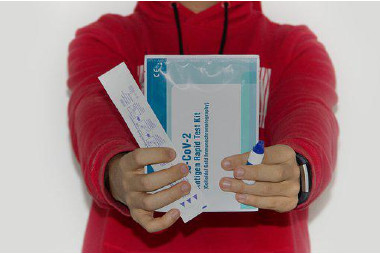

Tax Deduction for COVID-19 tests

From 1st July 2021, if you’re an employee, sole-trader or contractor and you pay for a COVID-19 test out of your own pocket for a work-related purpose, such as to determine whether you can attend or remain at work, you…

Fiducian Economic March 2022 Commentary

ECONOMIC OUTLOOK GLOBAL ECONOMY The global economy has been continuing to recover from its contraction by 3.1% in 2020, its deepest recession since the Second World War. This recession was caused by government restrictions on economic activity imposed to counter…

2022–23 Federal Budget Tax and Superannuation Highlights

The Federal Treasurer, Mr Josh Frydenberg, handed down the 2022–23 Federal Budget at 7:30pm (AEDT) on 29 March 2022. In an economy emerging from the pandemic, the Treasurer has confirmed an unemployment rate of 4% and an expected budget deficit…