Budget Newsletter 2017

With changes in previous budgets around pre and post retirees and focus on small business, the budget this year appears less likely to significantly impact retirement planning. It is important to note that before any of these announcements can be implemented they will require the passage of legislation and they may be subject to change.

If you would prefer a summary please read where it says “Find Out More”*

Additional super contributions for down-sizers from 1 July 2018, people aged 65 and over will be able to make a non-concessional superannuation contribution of up to $300,000 from the proceeds of the sale of their home. Both members of a couple will be able to apply this measure allowing up to $600,000 per couple to be contributed to superannuation. Contributions made under the downsizing cap will be in addition to any other voluntary contributions a person is able to make under the existing contribution rules and caps. This could mean lower tax on your savings and potentially better returns from the investments

Additional super contributions for down-sizers from 1 July 2018, people aged 65 and over will be able to make a non-concessional superannuation contribution of up to $300,000 from the proceeds of the sale of their home. Both members of a couple will be able to apply this measure allowing up to $600,000 per couple to be contributed to superannuation. Contributions made under the downsizing cap will be in addition to any other voluntary contributions a person is able to make under the existing contribution rules and caps. This could mean lower tax on your savings and potentially better returns from the investments

The Government has confirmed that downsize sale proceeds contributed to superannuation will be counted under the Age Pension Assets Test. This measure will provide significant additional flexibility to those retirees looking to structure income streams for their retirement including those downsizing for lifestyle, to raise capital or for additional care requirements.

To provide a tax effective way of saving for a home deposit, the Government will allow voluntary superannuation contributions to be withdrawn for a first-home deposit. From 1 July 2017 an amount up to $15,000 per year of voluntary contributions (concessional or non-concessional) within the existing contribution caps can count towards this measure, up to $30,000 in total. Normal tax rules on contributions will apply. From 1 July 2018 these amounts can be withdrawn for a first home deposit along with associated deemed earnings. – Withdrawals relating to concessional contributions will be taxed at a person’s marginal rate less a 30% offset. Non-concessional contributions withdrawn will not be taxed. – The measure is applied per person, meaning both persons in a couple buying their first home will be eligible to apply for this scheme.

Before making contributions under this scheme, first home savers, you should consider your personal circumstances including what type of contribution could be most effective and the tax rate payable on earnings inside superannuation compared to their effective tax rate outside of superannuation. It is best to contact us if you need assistance.

Increase in waiting period before getting government benefits

The maximum Liquid Assets Waiting Period will increase from 13 weeks to 26 weeks from 20 September 2018. The maximum 26 weeks waiting period applies where liquid assets are equal to or exceed $18,000 for singles (formerly $11,500) without dependants or $36,000 (formerly $23,000) for couples and singles with dependants.

Pensioner Concession Card reinstatement.

The Government will reinstate the Pensioner Concession Card (PCC) for former pensioners who were no longer eligible to receive the Age Pension because of the Assets Test from 1 January 2017. These former pensioners will receive the PCC from 9 October 2017 and they will retain the Commonwealth Seniors Health Card to ensure they continue to receive the Energy Supplement.

Enhanced residency requirements for Aged Pensioners

From 1 July 2018, people who want to claim Centrelink benefits, will be required to have 15 years of continuous Australian residence. There are some exemptions and it would be best to call us first if this applies to you

Family Tax Benefit payments not increasing

The Government will maintain the current Family Tax Benefit (FTB) Part A payment rates for two years at their current levels from 1 July 2017. Indexation of the FTB payment rates using the Consumer Price Index will resume on 1 July 2019.

Extending the immediate deductibility threshold for small businesses

Small businesses, with aggregate annual turnover of less than $10 million, can immediately deduct purchases of eligible assets up until 30 June 2018, provided the asset costs less than $20,000. Assets valued at $20,000 or more can continue to be placed into the small business simplified depreciation pool and depreciated at 15% in the first income year and 30% each income year thereafter.

The pool can also be immediately deducted if the balance is less than $20,000 over this period. From 1 July 2018, the immediate deductibility threshold and the balance at which the small business simplified depreciation pool , will revert back to $1,000.

0.5% increase in Medicare levy

From 1 July 2019, the Medicare levy will increase by 0.5% to 2.5% of taxable income, effectively increasing the top marginal tax rate (which includes the fringe benefits tax rate) to 47.5% The Temporary Budget Repair levy will expire on 30 June 2017 as originally announced in the 2014-15 Federal Budget.

Increase to Medicare levy low-income thresholds

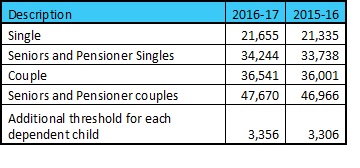

The following table shows an increase to when the Medicare levy applies.

Reduced residential property deductions

From 1 July 2017, there may be a change to what you can claim on an investment property. Items such as dishwashers and fans are in question. The reason why is these items are depreciation deductions on plant and equipment which can easily be removed from the property. You are therefore only able to claim this item while you own the property. For plant and equipment purchased after the 9 May 2017, deductions are claimable over the effective life of the asset.

For investors with existing investments as at Budget night, grandfathering rules will apply, allowing deductions on plant and equipment to continue until either the investor no longer owns the asset or the asset reaches the end of its effective life.

Travelling to your Investment Property will now Cost You.

Also from 1 July 2017, the Government will no longer allow deductions for travel expenses related to inspecting, maintaining or collecting rent for residential rental property. However, where investors engage third parties such as real estate agents and property management services, those expenses continue to be deductible.

What’s next?

Most changes must be legislated and passed through Parliament before they apply. If you think you may be impacted by some of the Budget’s proposed changes, you should consider seeking professional advice.If you feel you are affected by the above changes please do not hesitate to call us on 03 9848 5933. Getting started will give you Peace of Mind.

Lindale Insurances Pty ltd ATF Lindale Insurances Trust ABN 27 027 421 832 is a Corporate Authorised Representative of Millennium3 Financial Services Pty Ltd ABN 61 094 529 987,

AFSL 244252. This information (including taxation) is general in nature and does not consider your individual circumstances or needs. Do not act until you seek professional advice and consider a Product Disclosure Statement.

*- The attached link was provided by our partners the Association of Financial Advisers