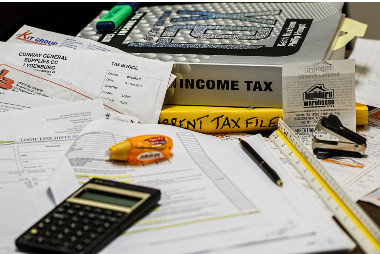

Claiming a tax deduction for motor vehicle expenses – small business

As a business owner, you can claim a tax deduction for expenses for motor vehicles used in running your business. Types of Vehicles and Claimable Expenses for Tax Purposes Definition of Cars for Income Tax Purposes: Cars: Motor vehicles (including…